If your property is on the delinquent tax sale list we may be able to help!

If your property is on the delinquent tax sale list we may be able to help!

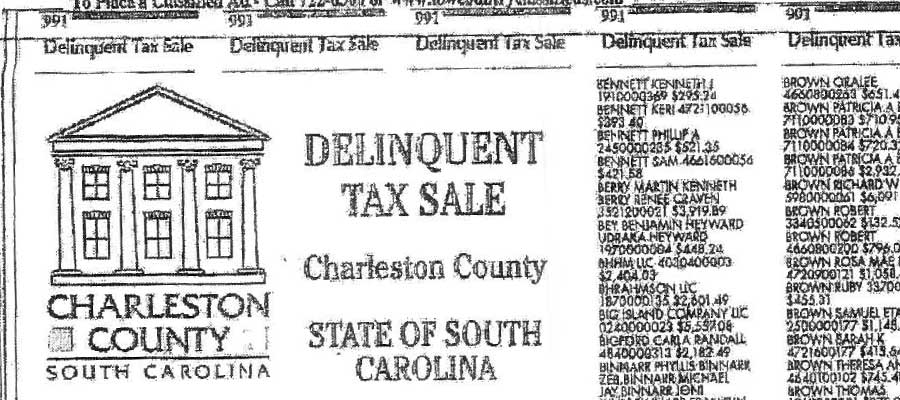

When a property owner fails to pay property taxes for the previous year the county will list the property on the delinquent tax sale list. The delinquent tax sale usually takes place at the end of the year. The exact dates vary for different counties in South Carolina. This year the Charleston County delinquent tax sale, for example, is scheduled for December 11 – Monday. You can view the list of all delinquent tax sale dates by county here.

What is a Delinquent Tax Sale?

A delinquent tax sale is simply a sale of the property tax debt that was not paid by the current property owner. The auction is not for the ownership of the property, but rather the property tax debt along with processing fees. The sale takes place in a format of a public auction where anyone can participate, except the current property owner.

What Happens to the Property After a Delinquent Tax Sale?

After the sale, a property owner typically has 1 year to redeem the property by paying back the past due taxes along with fees and interest. If the property owner fails to redeem the property, the county will sign the deed to the property over to the winning bidder from the tax sale auction. At this point, the highest bidder becomes the new owner of the property because the property was not redeemed by the defaulting taxpayer.

Are There Financing Options to Pay Delinquent Property Taxes?

If you failed to pay property taxes we may be able to help you secure the funds to pay back the delinquent taxes. Using these funds you can get your property removed from the tax sale list prior to the delinquent tax sale. You can also use the funds to redeem your property after the tax sale. We can work with you to secure short-term mortgage loans to pay off liens, mortgages and delinquent property taxes. There are certain conditions that the property must meet.

- All investment residential and commercial properties qualify, this includes rental properties, fix and flip projects, mobile home parks, land, etc. The property cannot be a primary residence. In other words, a residential property such as a single-family home, cannot be occupied by the owner.

- The property should have no mortgages or a low mortgage balance compared to the property value. If you have an existing $75,000 mortgage against a property worth $100,000 the LTV is 75%. A 75% loan-to-value is considered high. A high LTV will prevent us from being able to secure the funds to refinance and pay off your delinquent property taxes.

- You need to have an exit strategy. How will you pay off the loan?

If the above points fit your scenario, you can apply to see if you qualify. In any case, you need to act quickly. Never wait until the end of the redemption period or you will lose your property if you fail to redeem it in time.